Welcome back to CLEATZ, where prediction markets, player props, and public betting data collide to uncover the smartest bets and the sharpest statistical edges.

Today, we’re breaking down the Super Bowl Champion market on Kalshi, and spotlighting what appears to be real “mispricing” in the Bitcoin low-price for January market

Additionally, you can find our NBA, CBB, NFL data via these links. Our NFL props data will be available on Thursday.

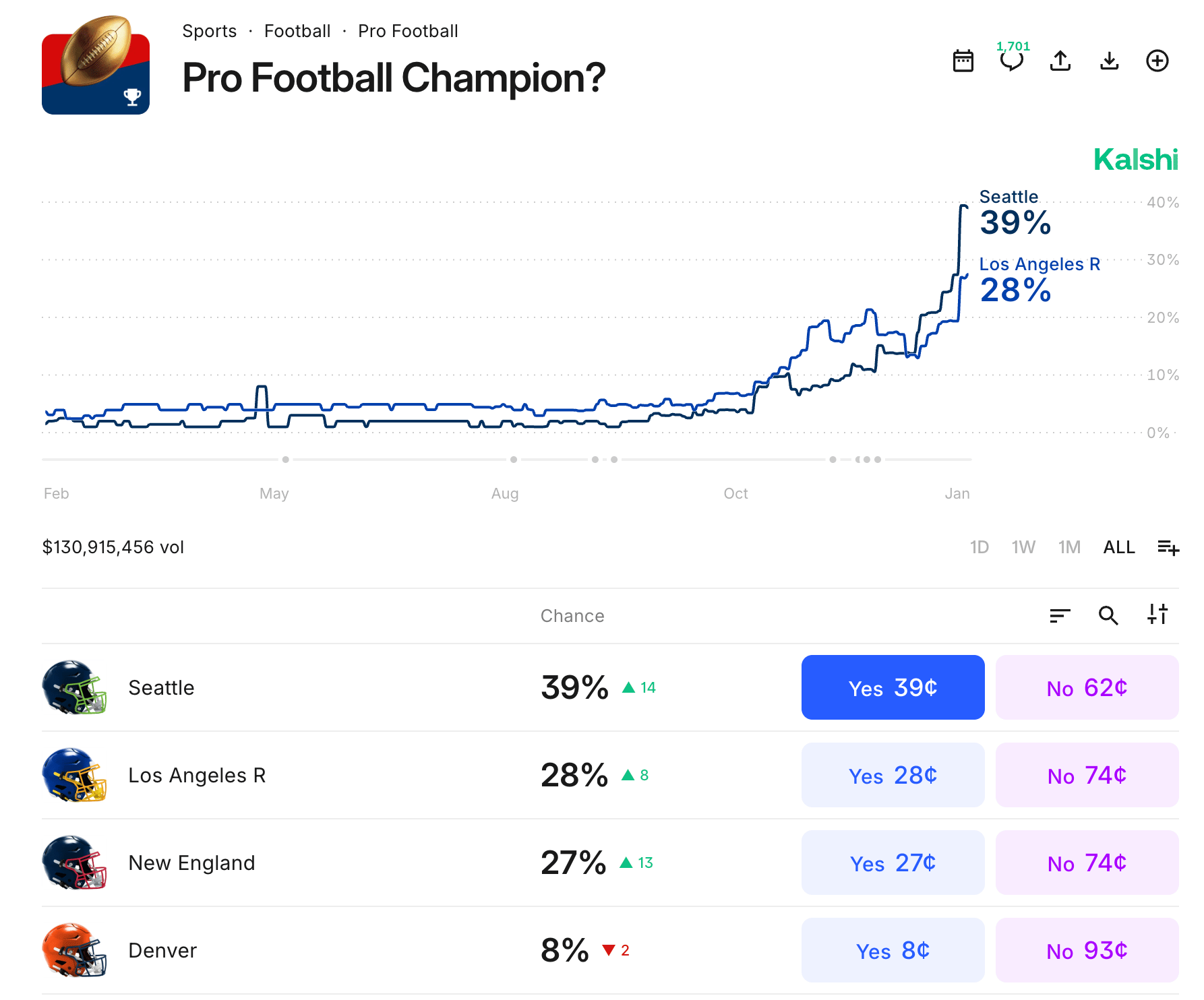

🏈 Super Bowl Champ Trading Value on Kalshi

Evaluating Current Prices

Team | Kalshi % | Implied SB Win Path |

|---|---|---|

Seattle | 39% | ~62% Conf × ~63% SB |

LA Rams | 28% | ~53% Conf × ~53% SB |

New England | 27% | ~52% Conf × ~52% SB |

Denver | 8% | ~28% Conf × ~29% SB |

These are not insane numbers anymore — but relative pricing still matters.

Where the Edge Actually Is Now

① Seattle Is Still the Most Fragile Price

Even in a Final-4 scenario:

39% implies Seattle is meaningfully better than every remaining team

But they still must beat:

A conference finalist

An elite SB opponent from the other conference

Seattle being +11% ahead of LA / NE is aggressive unless:

They are a clear favorite in both games

Injury report stays clean

Weather/matchup variance breaks right

That’s a thin margin of safety at this stage.

② LA Rams + New England = Structural Value Pair

LA (28%) and New England (27%) are priced as near equals, yet:

One of them is guaranteed to reach the Super Bowl

One Super Bowl win cashes

Combined probability = 55% vs Seattle’s 39%

You’re effectively betting:

“Seattle does NOT win two straight games”

— but with two live bullets instead of one.

③ Denver Is Correctly Priced

At 8%:

Denver is clearly the weakest team

But at Final 4, even bad teams have paths

8¢ is neither a slam-dunk buy nor sell

You are better off buying in on Denver in their specific matchup with the Patriots and hope the Broncos score first, thus providing a quick and profitable exit.

Optimal Trade Setups

🟢 Seattle — NO @ 62¢

Why this still works:

You win if Seattle loses either game

Seattle must be the best team twice

Any injury, turnover luck, or matchup issue kills the position

This is now a classic “overpriced favorite in a short tournament” fade.

🟡 Best Long Exposure

Buy BOTH:

LA Rams YES @ 28¢

New England YES @ 27¢

This gives you:

One guaranteed Super Bowl participant

Two independent ways to win

Lower variance than Denver YOLO

Better EV than Seattle YES

Tactical Momentum Trade

If Seattle wins the conference title game:

Price likely spikes to 50–55%

Sell into Super Bowl week hype

Do not hold to kickoff unless hedged

This is a pure sentiment + liquidity trade, not fundamentals.

What Not to Do

❌ Buying Seattle YES at 39¢ to hold

❌ Over-allocating to Denver

❌ Ignoring cross-hedging opportunities between LA /

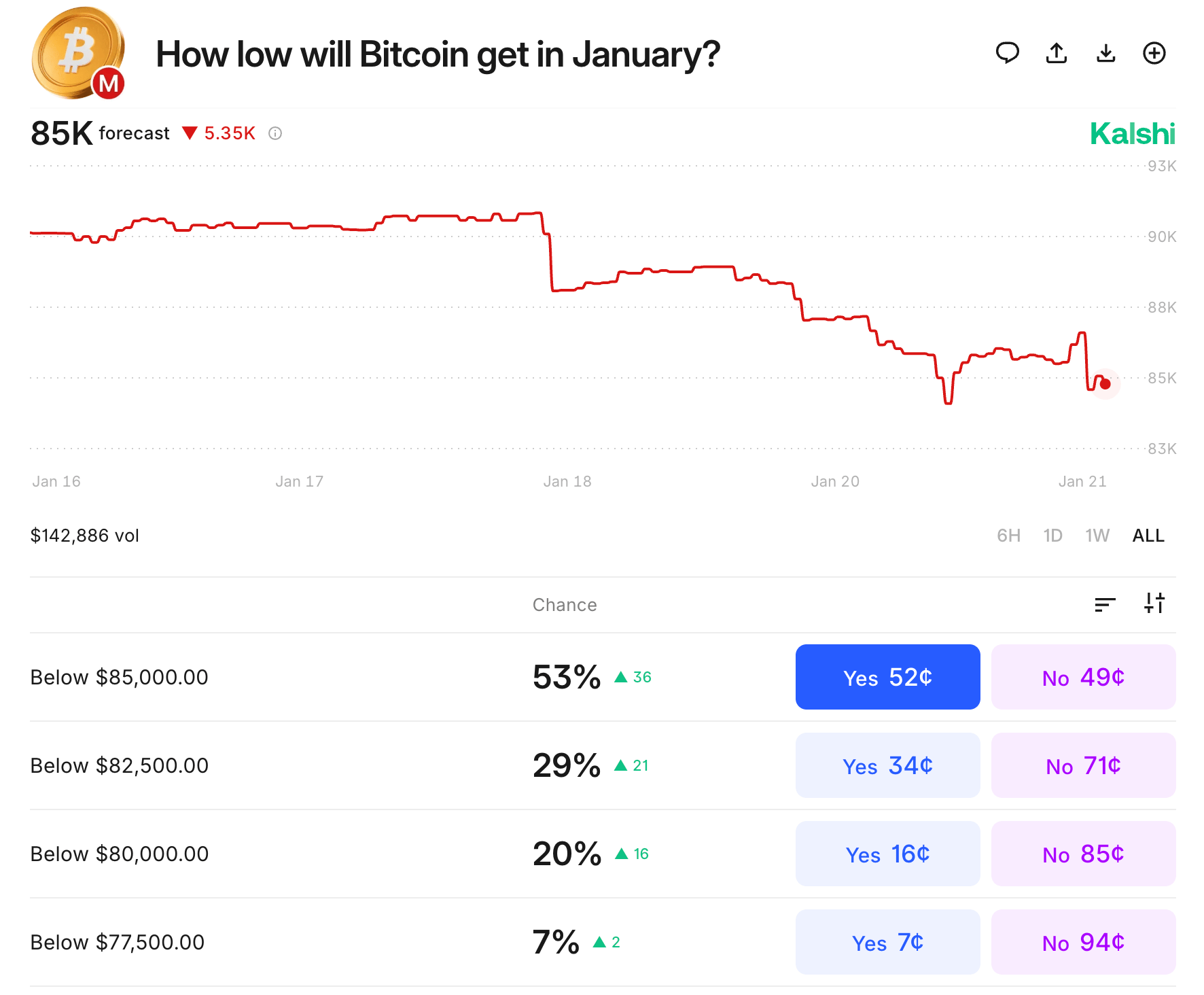

📉 Kalshi Market: How Low Will BTC Go in January?

There is a TON of value here if you play it right over the next 10 days. We break down the approach below.

Price action:

Sharp step-downs (not smooth consolidation)

Failed bounces

Volatility expanding after downside breaks

→ Classic distribution → markdown transition

Historical Bitcoin Pattern That Matters Here

① Post-ATH “False Plateau” Phase

Seen in: 2013, 2017, 2021

BTC often appears stable near highs after the macro peak — before accelerating lower.

Sideways chop fools dip buyers

Volatility compresses briefly

Then range low breaks → air pocket

➡️ Current chart shows exactly this: flat → sudden step down → weak bounce → lower lows.

② Support Levels Rarely Hold on First Test

In prior cycles:

First major “round number” breaks (e.g. $20k in 2018, $40k in 2022) did not hold

BTC typically overshoots support by 10–25% before stabilizing

Applied here:

$85k = psychological + recent local floor

History says price often trades through these levels, not to them

➡️ This alone supports Below $82.5k and Below $80k as very plausible.

③ Liquidity Cascades Are Fast

Once BTC enters a true risk-off phase:

Forced selling (ETFs, levered longs, miners)

Derivatives liquidations cluster

Price moves faster than probability markets adjust

In 2021–22:

BTC dropped ~18% in <3 weeks

Prediction markets consistently lagged downside

From ~$90k:

$77.5k is only ~14% lower

➡️ Historically not extreme at all for January-style drawdowns

🔥 Why the Tail (Below $77,500) Is Underpriced

Market currently prices only 7% for sub-$77.5k.

But historically:

Once BTC loses its post-ATH range → drawdowns accelerate

Volatility clusters after support breaks, not before

January has produced several waterfall-style moves (2015, 2018, 2022)

Key insight:

Prediction markets tend to:

Price linear moves

Undervalue non-linear regime shifts

This is a regime shift chart, not a pullback chart.

Recommendation by Level (Directional Thesis)

Level | Thesis |

|---|---|

Below $85k | ✅ Base case — already effectively in play |

Below $82.5k | ✅ Strong value if momentum continues |

Below $80k | ⚠️ High-convexity zone — history supports |

Below $77.5k | 🔥 Best asymmetric tail if bear confirms |

Strategic framing:

Treat this as a laddered downside exposure, not a single bet

The worst mistake historically is assuming BTC “won’t go there” once momentum flips

Final Take

Bitcoin does not drift into bear markets — it falls into them.

If prior cycles rhyme:

The lowest-probability outcomes are often the correct ones — just late.

NEXT NEWSLETTER - TOMORROW THURSDAY, JAN. 22:

NFC & AFC Title Game Prop Picks

NBA Prop Winners

Trading weather markets on Kalshi….yes, we are serious!